The AI bubble becomes a concern when speculation outweighs real adoption. Warning signs include inflated valuations, excessive hype, lack of differentiation, slowing productivity gains, and investment concentration. Recognizing these helps investors and businesses prepare for potential corrections without missing long-term AI opportunities.

KumDi.com

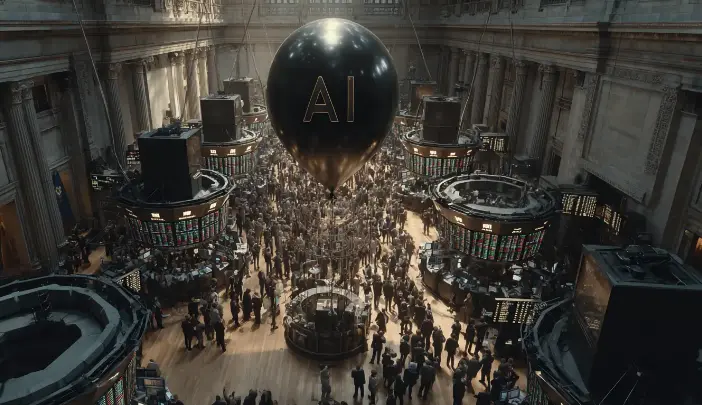

Artificial intelligence is booming, but experts warn that an AI bubble may be forming. Just like the dot-com era, excessive hype and inflated valuations can create risks for investors and businesses. Knowing when to worry about the AI bubble means watching for clear warning signs before speculation overtakes reality.

Artificial intelligence (AI) has become one of the fastest-growing technological revolutions of our time. From powering chatbots and medical diagnostics to transforming logistics and creative industries, AI is everywhere. The surge in investment has made AI the darling of Wall Street, venture capitalists, and global governments alike.

But behind the excitement, a critical question arises: are we in an AI bubble?

Like the dot-com era of the late 1990s, there is a risk that hype and speculation could push valuations beyond sustainable levels. For investors, businesses, and everyday professionals, knowing when it’s time to worry about the AI bubble is crucial.

This article explores the warning signs of an AI bubble, potential risks if it bursts, and strategies to stay grounded in the midst of both hype and genuine innovation.

Table of Contents

What Is a Tech Bubble, and How Does It Relate to AI?

A bubble occurs when enthusiasm and speculation drive asset prices far above their intrinsic value. In tech, this often happens when breakthrough innovations create massive excitement before sustainable business models are proven.

Examples of Past Bubbles:

- Dot-Com Bubble (1990s): Startups added “.com” to their names and skyrocketed in valuation despite having no profits. When the bubble burst, trillions of dollars in value evaporated.

- Crypto Boom and Crash (2017–2018): The promise of blockchain led to skyrocketing token prices, many of which collapsed after regulatory and practical issues emerged.

- Housing Crisis (2008): Overconfidence in rising real estate prices created unsustainable lending practices and a global financial crash.

Now, with AI startups valued at billions and promises of replacing entire industries, analysts see parallels with past bubbles. The question is: how much of AI’s rise is sustainable, and how much is inflated?

Warning Signs of an AI Bubble

1. Unsustainable Valuations

When AI companies raise hundreds of millions in funding despite having minimal revenue—or when stocks trade at 100x future earnings projections—this signals overvaluation. Such gaps between price and performance often precede corrections.

Example: A startup claiming to revolutionize drug discovery with AI but still years away from clinical trials valued at over $10 billion.

2. Excessive Hype in Media and Marketing

Hype is not inherently bad—it fuels innovation and attracts funding. But when media headlines proclaim that AI will “replace humans” or “end all jobs” without addressing limitations, the hype cycle spins out of control.

In the Gartner Hype Cycle model, this stage is called the Peak of Inflated Expectations, where optimism overshadows reality.

3. Mass Market Entry Without Differentiation

Suddenly, every app and service brands itself as “AI-powered.” But often, these products are simply wrappers around existing large language models (LLMs) like ChatGPT or other open-source systems.

This lack of differentiation mirrors the dot-com era when every startup launched a website with no clear value proposition.

4. Slowdown in Real Productivity Gains

If AI adoption continues growing but measurable productivity improvements plateau, it suggests hype is outpacing impact. For instance, if companies adopt AI tools but employee output doesn’t significantly increase, valuations tied to “productivity miracles” may falter.

5. Concentration of Investment in Few Giants

When most funding flows to a handful of companies—OpenAI, Anthropic, Google DeepMind, NVIDIA—the ecosystem becomes fragile. Smaller innovators may struggle, leaving the industry vulnerable if one or two leaders stumble.

6. Speculative Investment Behavior

When retail investors buy AI-related stocks solely based on trends rather than fundamentals, it mimics the FOMO (fear of missing out) behavior seen in other bubbles. Online forums hyping “the next AI stock” without analysis are red flags.

Risks of an AI Bubble Burst

If the AI bubble pops, the impact could ripple across industries:

- Investor Losses: Trillions in market value could evaporate, especially for overvalued startups.

- Layoffs in Tech: AI startups with unsustainable burn rates could collapse, leading to widespread job losses.

- Public Distrust: Failed promises could erode consumer confidence, delaying adoption.

- Innovation Setback: Legitimate research and development could face funding shortages, slowing genuine breakthroughs.

The good news: even after a bubble bursts, core technologies often survive and thrive—as seen with the internet after the dot-com crash.

How to Prepare for AI Bubble Risks

1. Focus on Fundamentals

Prioritize companies with proven revenue streams, customer adoption, and sustainable business models.

2. Track Regulation and Policy

Governments worldwide are creating AI regulations on data privacy, ethics, and safety. These could either stabilize or destabilize markets depending on how they’re enforced.

3. Diversify Investments

Avoid going “all-in” on AI. A balanced portfolio across industries cushions against sudden downturns.

4. Look for Tangible Use Cases

AI solutions solving real problems—like medical imaging, fraud detection, or logistics optimization—are less likely to collapse when hype fades.

5. Stay Informed on Market Sentiment

Monitor venture capital trends, adoption rates, and media tone. A sudden shift from optimism to skepticism often precedes corrections.

Is AI Different from Other Bubbles?

Some experts argue that AI is fundamentally different from past bubbles:

- Foundational Technology: Like electricity or the internet, AI isn’t just an app or trend—it’s a platform with far-reaching applications.

- Widespread Adoption: AI tools are already being integrated into education, healthcare, finance, and entertainment.

- Strong Corporate Backing: Unlike crypto, AI has massive support from global corporations like Microsoft, Google, and Amazon.

Even if valuations correct, AI’s long-term trajectory may remain upward, as genuine adoption continues to grow.

Balanced Perspective: Hype vs. Reality

- Hype: Promises that AI will “replace all jobs” or “achieve human-level intelligence within years.”

- Reality: AI is powerful but still limited—struggles with reasoning, biases, and data dependence remain unsolved.

Understanding this gap between vision and execution helps businesses and investors stay grounded.

Conclusion: Navigating the AI Hype Cycle

The AI bubble debate isn’t about whether AI is valuable—it unquestionably is. The real challenge lies in separating sustainable innovation from speculative hype.

By recognizing warning signs—such as unsustainable valuations, excessive hype, and mass entry without differentiation—business leaders and investors can protect themselves from risk while still harnessing AI’s transformative power.

Even if short-term corrections occur, the long-term potential of AI as a foundational technology remains undeniable. The key is balance: embrace innovation, but stay vigilant against the dangers of hype.

FAQs

Are we already in an AI bubble?

We may be in a mini-bubble around certain startups, but AI overall has strong adoption trends that suggest long-term viability.

How do I know if an AI stock is overvalued?

Check revenue models, adoption metrics, and profitability. Extremely high valuations without proven performance indicate bubble risk.

Will an AI crash slow innovation?

Temporarily, yes. But like the internet after the dot-com crash, the strongest AI companies and applications will survive and continue innovating.

Should businesses still adopt AI?

Absolutely. But adoption should be strategic—focus on ROI and proven applications instead of chasing hype.

How long could the AI bubble last?

Bubbles often last longer than expected. AI hype could continue for years, but eventually markets correct when reality fails to match expectations.