Japan’s tourism stocks dive after China issued a travel warning in response to Takaichi’s Taiwan remarks, shaking Asia markets. The alert triggered immediate declines in airlines, retailers, and hotels as investors priced in reduced Chinese travel demand and rising geopolitical risks for Japan’s tourism economy.

KumDi.com

Asia markets were shaken as Japan tourism stocks dive following China’s travel warning issued after Prime Minister Takaichi’s Taiwan remarks. The advisory sparked immediate sell-offs in airlines, retailers, and hospitality companies, raising concerns about weakened Chinese inbound travel demand and the broader economic impact across the region.

Table of Contents

What Triggered the Market Drop?

The spark came from comments by Prime Minister Sanae Takaichi regarding Taiwan. Her remarks portrayed a hypothetical Chinese attack on Taiwan as a direct threat to Japan’s national security. Beijing responded firmly, criticizing the statement and urging its citizens to postpone or reconsider travel to Japan due to “safety concerns” and “deteriorating public sentiment.”

A travel advisory from China—Japan’s single largest source of tourists—carries enormous economic consequences. Markets instantly priced in the likelihood of fewer inbound visitors, lower retail spending, and weaker earnings for consumer-facing companies.

Within hours of the advisory becoming public, Japan’s tourism-linked stocks slid sharply across the board.

The Market Reaction: Tourism, Retail, Airlines Hit Hardest

Airlines

Japanese carriers such as ANA and Japan Airlines were among the earliest casualties. A sudden drop in bookings and rising concerns over cancellations pushed traders into risk-off mode. Airline stocks fell as investors anticipated reduced seat occupancy, lower route profitability, and the possibility of capacity adjustments.

Retail Heavyweights

Chinese visitors are a major force behind Japan’s retail sector—especially luxury, cosmetics, and electronics. Shares of department stores and brand-name retailers saw immediate pressure as the market priced in weaker sales projections. Stores in Tokyo, Osaka, and other major hubs rely significantly on duty-free spending from Chinese tourists, meaning even a short downturn can impact quarterly revenue.

Hotels & Hospitality

Hotel chains and travel-related service providers also felt the blow. Lower room bookings, fewer group tour arrivals, and reduced discretionary travel spending could weigh on earnings. Analysts noted that hotels in prime tourist zones like Ginza, Shinjuku, and Kyoto might be hit hardest if the advisory persists.

Theme Parks & Entertainment

Companies operating major leisure attractions, including theme parks, experienced a decline as well. Chinese families and tour groups make up a considerable slice of foreign visitors at Japan’s biggest entertainment destinations. Fewer inbound arrivals could lead to thinner operating margins, especially during peak seasons.

Why Chinese Tourism Matters So Much to Japan

To understand the scale of the market reaction, it’s important to realize how deeply intertwined Japan’s leisure economy is with Chinese visitor spending.

Before the pandemic:

- Chinese tourists made up a massive share of Japan’s total inbound arrivals.

- They accounted for a disproportionately high percentage of luxury and department-store purchases.

- Their spending habits supported airlines, hotels, restaurants, cosmetics brands, and more.

After reopening:

Japan pinned much of its tourism recovery on the return of Chinese visitors. Retailers expanded multilingual services, travel operators invested in new routes, and cities made infrastructural upgrades anticipating increased traffic from mainland tourists.

A government-issued travel warning from China risks stalling that recovery—potentially erasing months of momentum. That’s why the market’s reaction was both swift and severe.

Broader Impact on Asia Markets

The fallout wasn’t limited to Japan alone. Investors across Asia began to reassess risks connected to:

- diplomatic stability,

- consumer sentiment,

- cross-border travel flows,

- and exposure to the China-Japan economic corridor.

Regional spillovers could include:

- Lower demand for regional airline routes linking China and Japan

- Reduced export and retail sales for brands heavily dependent on tourist-driven purchases

- Risk-off sentiment flowing into ETFs and mutual funds focused on Asia-Pacific consumer sectors

- Increased volatility in Asian currencies as investors weigh geopolitical risks

As tensions rise, market volatility tends to spread beyond geographical boundaries.

Diplomatic Moves to Watch

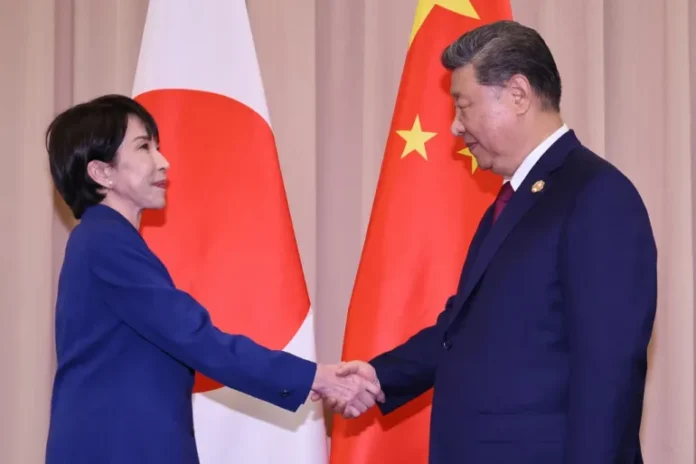

Japan took quick steps to ease the situation by sending a senior envoy to China. Diplomatic channels are now being used to clarify Japan’s position and de-escalate sentiment.

Investors will be watching for:

- official statements from Beijing and Tokyo

- any softening or reversal of the travel advisory

- scheduling of bilateral meetings

- language shift in state media

- cues from tourism authorities and carriers

If diplomatic signals turn constructive, markets could rebound. If rhetoric hardens, expect more turbulence.

How Companies May Respond

Corporate management teams across Japan’s tourism and retail sectors are likely preparing contingency plans.

Airlines

- Introduce flexible rebooking/refund policies

- Redirect aircraft to routes with stronger demand

- Scale back promotional fares for China-bound travelers

Retail & Department Stores

- Increase domestic-targeted marketing campaigns

- Adjust inventory levels to avoid overstocking

- Roll out limited-time promotions to boost local sales

Hotels

- Offer discounted stays or loyalty perks to locals

- Shift focus to travelers from Southeast Asia, Korea, and Western markets

Theme Parks

- Add localized promotional events

- Reduce operational overhead during low-volume periods

If the advisory lasts more than a few weeks, companies may revise earnings guidance for the next quarter.

What Investors Should Monitor Next

For traders and long-term investors, several indicators will determine whether the downturn is temporary or structural:

1. Booking and Travel Data

Watch airline reservations, hotel occupancy, and tour group activity. Any sharp week-to-week drop would signal deeper trouble.

2. Corporate Earnings Guidance

If retailers, hotels, or airlines cut revenue forecasts, expect further stock pressure.

3. Diplomatic Tone

Geopolitics created the shock. Only geopolitics can calm it.

4. ETF and Fund Flows

Increased outflows from Japan-focused or Asia consumer ETFs would indicate broader fear.

5. Market Volatility

Options pricing in tourism and retail stocks can reveal whether traders expect prolonged instability.

Investment Outlook: Short-, Medium-, and Long-Term

Short-Term Outlook (1–4 weeks)

Expect elevated volatility. Traders may avoid tourism stocks until there’s more clarity. Defensive positioning—especially hedging Japan exposure—may continue.

Medium-Term Outlook (1–3 months)

If diplomacy cools tensions, some of today’s sharply hit stocks could look oversold. Bargain-hunting may emerge, especially in firms with diversified revenue streams.

Long-Term Outlook (1 year or more)

Temporary geopolitical shocks come and go. Japan’s tourism appeal, infrastructure quality, and brand power suggest the sector will eventually recover. Long-term investors should differentiate between temporary demand shocks and long-term structural changes.

Companies with strong domestic bases, omnichannel strategies, or broad Asia exposure typically recover faster than those reliant on a single tourist segment.

Conclusion: A Reminder of How Fast Geopolitics Can Move Markets

The plunge in Japan’s tourism-exposed stocks is a vivid reminder that political rhetoric can translate into economic consequences overnight. Whether this becomes a prolonged downturn or a short-lived market scare depends heavily on how Beijing and Tokyo navigate the diplomatic landscape in the weeks ahead.

For now, Asia markets remain cautious, Japan’s consumer sectors are under pressure, and investors are watching closely for signals that the situation is stabilizing.

If relations cool and travel sentiment recovers, today’s turbulence may later be viewed as a temporary dislocation. If tensions harden, however, Japan’s recovery narrative—especially in the tourism sector—could face a more complicated road ahead.

FAQs

Why did Japan tourism stocks dive after China’s travel warning?

Japan tourism stocks dive because China’s travel warning reduced expected visitor demand, increasing volatility across Asia markets and amplifying concerns linked to Takaichi’s Taiwan remarks.

How does China’s travel warning impact Asia markets overall?

The China travel warning triggers risk-off sentiment, affecting Asia markets impact by lowering tourism revenue expectations and strengthening geopolitical effects tied to Takaichi’s Taiwan remarks.

Which sectors are most affected by the Japan tourism stocks dive?

Airlines, hotels, retailers, and leisure operators are the most impacted sectors as Japan tourism stocks dive, influenced by weaker inbound demand and the China travel warning.

What role did Takaichi’s Taiwan remarks play in Asia market volatility?

Takaichi’s Taiwan remarks intensified tensions, prompting China’s travel warning and contributing to Asia markets impact as investors reassessed geopolitical risks.

How long might the effects of the China travel warning on Japan tourism stocks last?

The duration depends on diplomatic progress. If tensions ease, Japan tourism stocks dive effects could fade; if not, Asia markets impact may persist due to reduced travel demand.