Trump Tariffs 2025 are expected to slow global trade, raise inflation, disrupt supply chains, and reduce GDP growth by year-end. Both U.S. and global economies face long-term structural adjustments due to high import taxes and trade policy uncertainty.

KumDi.com

By the end of 2025, Trump’s sweeping new tariffs are projected to fundamentally alter global trade and the economy. With import duties reaching up to 50%, supply chains are shifting, inflation is rising, and global GDP is slowing. This article explains the key changes, risks, and realignments ahead—focusing on the Trump 2025 tariffs global trade impact and what it means for businesses, governments, and consumers worldwide.

As of mid-2025, former President Donald Trump’s second-term trade policy—marked by aggressive tariff increases—has had sweeping effects on global trade and economic performance. With tariffs reaching up to 50% on key imports, global supply chains are being rerouted, inflation is rising, and growth is slowing. This article explores how these changes will likely play out by the end of 2025 and what long-term structural impacts they may bring.

Table of Contents

Tariff Policy Summary

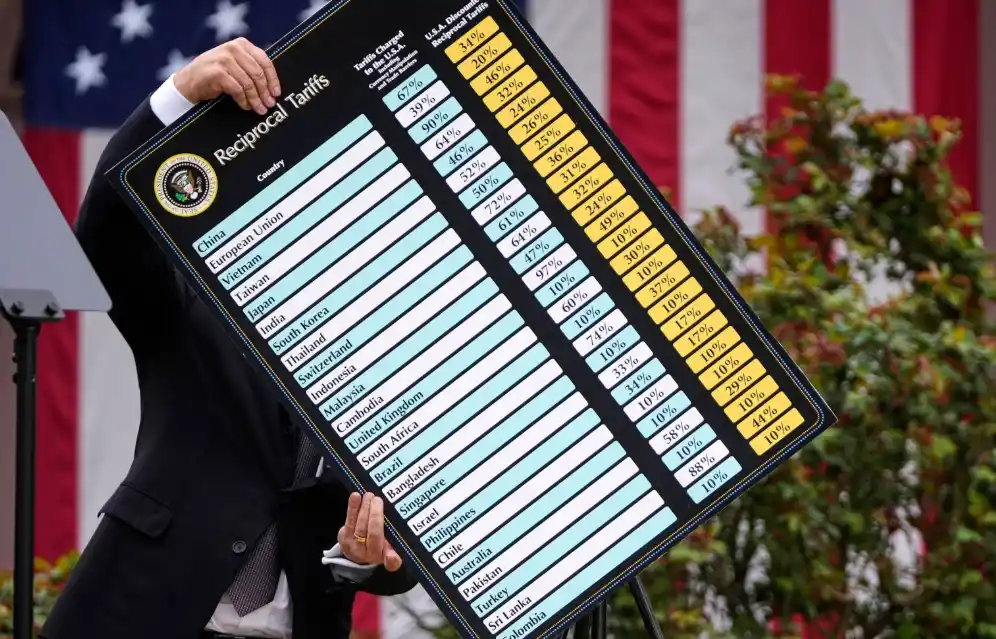

In April 2025, the U.S. imposed sweeping tariffs: 10% on most imports, and 15–50% on goods from countries like China, Mexico, and Canada. Court battles have challenged legality, but the majority remain in effect. Bilateral trade deals have adjusted terms with partners like the UK, EU, and Japan.

U.S. Economic Impact

- GDP expected to drop 0.9 percentage points by year-end

- Inflation increase of ~2.3% due to higher import costs

- Consumer cost: +$2,100–$3,800 annually per household

- Unemployment expected to rise by 0.5 percentage points

- Manufacturing benefits slightly, while sectors like agriculture and construction contract

Global Economic Impact

- Global GDP growth down 0.2–0.8 percentage points

- U.S.–China trade drops by up to 90%

- Supply chains realign through Mexico, Vietnam, and Korea

- Canada and China see long-run GDP drops (~2% and 0.2%, respectively)

- UK and EU see small gains (~0.1–0.2%) due to new U.S. trade deals

Trade Volume and Supply Chains

Global trade is forecast to decline by about 5%. Firms shift supply chains regionally or bilaterally. Multinational manufacturers redirect operations to avoid U.S. tariffs. However, these changes add costs and reduce efficiency.

Fiscal and Inflationary Effects

Tariffs raise $161–171 billion in U.S. tax revenue, making them the largest tax increase since 1993. Consumer inflation rises, especially in sectors like apparel and electronics. Lower-income households are disproportionately impacted.

Political and Legal Uncertainty

Legal challenges over the use of emergency trade powers (IEEPA) create instability. Executive orders continue to shape trade without Congressional oversight, reducing investor confidence and discouraging long-term planning.

Structural Shifts

- Multilateralism is replaced by selective bilateral deals

- Increased fragmentation of trade rules

- Rise of regionalization in supply chains

- Geopolitical tensions escalate between U.S. and traditional allies

- Slower innovation and reduced investment in high-tech sectors

End of 2025 Outlook

- Global GDP growth forecast: ~3.0%

- U.S. GDP growth forecast: ~1.7–1.9%

- Global trade volume: ~5% lower than in 2024

- Inflation persists, especially in import-heavy sectors

- Trade policy uncertainty remains high

Conclusion

Trump’s 2025 tariffs have triggered major changes in global commerce. While they generated short-term revenue and some manufacturing gains, they have also led to lower growth, higher inflation, and strained international relations. By the end of 2025, the global economy will be more fragmented, less efficient, and burdened by long-term structural adjustments.

FAQs

How are Trump’s 2025 tariffs expected to affect global trade?

Trump’s 2025 tariffs will reduce global trade volumes by nearly 5%, especially affecting US-China trade. Supply chains will be rerouted to avoid high tariffs, which raises costs and disrupts logistics.

What is the economic forecast for the U.S. due to the 2025 tariffs?

The U.S. is expected to see 0.9% lower GDP growth and up to 0.5% higher unemployment by the end of 2025. Inflation is projected to rise by about 2.3%.

How will consumers be affected by Trump’s tariffs in 2025?

Consumers may pay $2,100–$3,800 more annually due to increased prices on imported goods. Low-income households will be hardest hit.

What countries are most impacted by the 2025 U.S. tariffs?

China, Canada, and Mexico face the steepest losses, while the UK and EU may benefit slightly from new trade deals.

Are Trump’s tariffs expected to be permanent or temporary?

While some tariffs may be reduced after bilateral negotiations, most are likely to remain into 2026, causing lasting global economic changes.