Japan $550 billion deal with Trump represents a massive financial and political commitment, combining investments and tariffs that reshape U.S.-Japan relations. While it secures short-term economic cooperation, critics say it comes at the cost of Japan’s fiscal balance and strategic independence.

KumDi.com

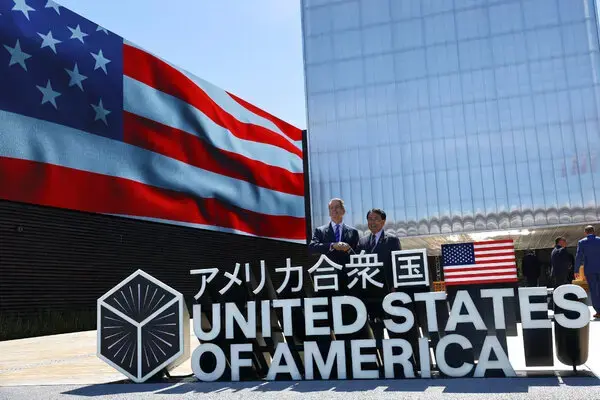

Japan $550 billion deal with the United States under Donald Trump marks one of the most significant financial and diplomatic commitments in decades. Designed to strengthen industrial cooperation and stabilize trade ties, the agreement is also forcing Tokyo to confront the real cost of political loyalty and economic leverage in an era of transactional diplomacy.

Japan’s latest $550 billion trade and investment package with the United States has drawn both applause and alarm. While the deal promises to strengthen strategic ties between Washington and Tokyo, it also exposes Japan to financial and political risks unprecedented in recent decades. The agreement, framed by the Trump administration as a “win-win” partnership, has left Japanese policymakers defending a move that many critics view as one-sided.

At its core, the deal represents a massive financial commitment — structured as investments, loans, and industrial partnerships — designed to meet American demands for “fairer” trade and greater Japanese participation in U.S.-based production. But behind the headlines lies a deeper story about power, diplomacy, and the costs of maintaining influence in a shifting global order.

Table of Contents

What the $550 Billion Deal Actually Means

The $550 billion figure often cited in headlines isn’t a lump-sum payment from Tokyo to Washington. Instead, it encompasses a wide range of Japanese-backed financing, corporate investments, and strategic industrial projects in the United States. These include initiatives in semiconductors, green energy, advanced manufacturing, and critical mineral supply chains.

Much of the funding will flow through Japan’s state-backed institutions, such as the Japan Bank for International Cooperation (JBIC) and Nippon Export and Investment Insurance (NEXI). These agencies will provide loans, guarantees, and equity financing to Japanese and American firms collaborating under the agreement. In practical terms, Japan is leveraging its public finance system to ensure U.S. access to capital and technology — in exchange for continued American security guarantees and market access.

From Washington’s perspective, it’s a deal that channels foreign money into U.S. industries while reinforcing economic nationalism. From Tokyo’s view, it’s a calculated move to preserve alliance stability and prevent more damaging trade penalties.

The Political Gamble in Tokyo

Domestically, the agreement has become one of the most polarizing political issues of the year. Supporters within Japan’s ruling coalition describe it as a strategic necessity — a “premium for security” that ensures American partnership amid growing regional tensions. They argue that investing heavily in U.S. industry strengthens Japan’s diplomatic leverage and helps shield its exporters from unpredictable tariffs.

Opponents, however, see it differently. Critics in the opposition and media have called the deal an “economic capitulation,” warning that Tokyo is overpaying for goodwill that may not last beyond the next U.S. election cycle. They question whether Japan should tie its long-term fiscal stability to the fluctuating demands of an American administration that views trade as a zero-sum game.

The political debate is especially heated because the deal coincides with Japan’s growing fiscal pressures. Public debt already exceeds 250% of GDP, and critics warn that any losses from state-backed projects could eventually burden taxpayers. While officials emphasize that the deal relies primarily on loans and guarantees — not direct budget spending — few believe the risk is entirely off the books.

Economic Impact: Winners and Losers

Winners

The immediate beneficiaries are expected to be large Japanese conglomerates in sectors aligned with U.S. industrial policy. Semiconductor producers, auto suppliers, and renewable energy firms will gain privileged access to U.S. markets, government contracts, and joint-venture opportunities.

American regions hosting new plants or facilities will likely enjoy a surge in investment and job creation, with billions in Japanese funding directed toward manufacturing hubs in Texas, Arizona, and Michigan.

Losers

For smaller Japanese exporters, however, the picture is less rosy. The deal’s tariff structure — with new ceilings around 15% on many categories — may still eat into profit margins for consumer goods, electronics, and automotive parts. Companies that rely heavily on exports rather than U.S.-based production will feel the squeeze most sharply.

Additionally, the massive outflow of capital toward U.S. projects could limit domestic investment in Japan’s own innovation ecosystem. Some economists warn that by funding America’s reindustrialization, Japan risks slowing its own technological renewal.

Strategic Rationale: Buying Time and Influence

Japan’s strategic logic behind the deal is clear: to maintain favor with the United States while buying time to strengthen its own economic independence. The agreement reflects a broader pattern in Tokyo’s foreign policy — balancing deference to Washington with gradual diversification toward Europe, Southeast Asia, and India.

Officials privately admit that the deal was partly about avoiding punitive measures. By offering substantial financial commitments, Japan hopes to avert deeper tariffs or forced restructuring of its exports to the U.S. automotive and electronics markets. The calculation is pragmatic: paying a high price now may secure predictability later.

At the same time, Tokyo views the partnership as a platform to influence U.S. industrial policy from within. By embedding Japanese firms in American supply chains, Japan aims to ensure that its technology and expertise remain indispensable even amid rising protectionism.

The Role of JBIC and Institutional Finance

The backbone of the $550 billion framework lies in how Japan mobilizes its state financial institutions. JBIC and NEXI, along with other public investment vehicles, are expected to underwrite a significant portion of the commitments. Their tools — ranging from export credit and political risk insurance to direct project financing — allow Tokyo to multiply the impact of public funds while minimizing direct budget exposure.

However, the risks are real. If projects fail, loans default, or demand falters, those contingent liabilities could migrate to the government’s balance sheet. Japan’s finance ministry faces the challenge of ensuring that these mechanisms don’t quietly expand public debt under the radar.

Transparency, oversight, and careful selection of projects will determine whether this massive financial mobilization becomes a symbol of strategic success or fiscal recklessness.

Global Ripple Effects

The implications of the Japan–U.S. deal reach far beyond bilateral trade. Other allies are watching closely, especially South Korea, the European Union, and Australia. If Washington expects similar “investment-for-access” arrangements, the global trade system could drift further from multilateral norms toward a web of transactional deals.

Such a shift would mark a profound transformation in the postwar economic order that Japan helped build. Instead of free trade and global integration, nations may increasingly pay for privilege — investing politically and financially to preserve access to American markets.

Emerging economies could find themselves squeezed out of global value chains as capital and production concentrate in politically favored regions. For Tokyo, that outcome is double-edged: it reinforces its alliance with the U.S. but risks fragmenting the very system that enabled Japan’s rise as a trading powerhouse.

The Domestic Tightrope Ahead

At home, Japan’s government must navigate a delicate balance between alliance management and public accountability. Opposition parties are calling for full disclosure of deal details — including project-level data, financing terms, and risk assessments.

Public opinion is mixed. Some view the agreement as necessary realism in an era of geopolitical uncertainty. Others see it as evidence that Japan is losing its autonomy, reduced to underwriting U.S. industrial ambitions.

The coming months will likely bring parliamentary hearings, media scrutiny, and pressure for transparency. If economic benefits fail to materialize quickly, political patience could wear thin.

Looking Forward: A Test of Strategic Endurance

The $550 billion package represents not just an economic choice but a philosophical one: how much Japan is willing to pay to maintain its role as Washington’s indispensable ally.

Whether it ultimately proves to be a smart investment or a strategic overreach will depend on execution — how effectively the funds are used, how transparently they’re managed, and how sustainably they serve Japan’s own national interests.

If Tokyo can turn the deal into a platform for deeper technological collaboration and shared innovation, it might emerge stronger. But if the arrangement becomes a drain on public resources or a symbol of political subservience, history may remember it as one of the most expensive lessons in modern diplomacy.

Conclusion

Japan’s $550 billion commitment to the U.S. reflects the complex trade-offs of global politics in 2025 — where economic strength, national security, and diplomatic survival are tightly intertwined.

For Washington, it’s a victory of leverage.

For Tokyo, it’s a test of resilience.

In the end, the true price of playing to Trump may not be measured in dollars, but in how Japan defines its independence in a world where alliances now come with a bill attached.

FAQs

What is Japan’s $550 billion deal with Trump?

Japan’s $550 billion deal refers to a large-scale investment and trade framework between Japan and the U.S., initiated under Trump’s leadership. It combines financial commitments, tariff negotiations, and industrial partnerships affecting both economies.

How does the Japan $550 billion deal impact the U.S.-Japan trade relationship?

The Japan $550 billion deal deepens the U.S.-Japan trade relationship by channeling Japanese capital into U.S. industries while introducing moderate tariffs. It’s a strategic move to secure market access and maintain political alignment amid global economic shifts.

Why is Japan paying such a high price in the Trump tariffs deal?

Japan is paying this price to preserve its economic access and political influence with the U.S. under the Trump tariffs policy. The deal acts as a safeguard against harsher trade measures while ensuring collaboration in sectors like semiconductors and clean energy.

What role does JBIC play in Japan’s $550 billion investment deal?

JBIC (Japan Bank for International Cooperation) finances key portions of the $550 billion investment through loans and guarantees, enabling Japanese companies to join U.S. projects without directly burdening Japan’s fiscal budget.

What are the long-term risks of Japan’s $550 billion deal with the U.S.?

The Japan $550 billion deal risks increasing public financial exposure and dependency on U.S. trade policy. Critics warn that Japan’s political and economic autonomy may weaken if future U.S. administrations alter or retract their commitments.